Loading component...

Get up to speed on the mobility industry - our newsletter straight to your inbox!

Get up to speed on the mobility industry - our newsletter straight to your inbox!

Although the sale of new, non-zero emission heavy goods vehicles (HGVs) will cease by 2040, it doesn’t take an expert to realise that the full market transition of all heavy duty vehicles (including buses and coaches) will take significantly longer than 17 years. 2006 doesn’t seem very long ago, after all.

Low-carbon renewable fuels contribute around 33% of all carbon savings from road transport and the increased use of lower carbon fuels in the heavy duty vehicle fleet represents the single greatest opportunity to reduce greenhouse gas (GHG) emissions.

The UK’s Zemo Partnership have just published the latest edition of their Renewable Fuels Guide and the report’s author, Gloria Esposito, says “We’re delighted to publish this new Guide to help heavy duty vehicle operators who are facing many other challenges find a way through the maze of guidance and regulations around cutting carbon emissions.

Intertraffic: Were you surprised by any of the findings in your extensive research? Were there any new trends that you weren’t expecting?

Gloria Esposito: No, not really, because the Zemo Partnership has published a previous Renewable Fuels Guide and we're heavily engaged with the downstream renewable fuels market and how that serves the commercial vehicle fleets and also non-road mobile machinery. For the past two years we have run an independent scheme called the Renewable Fuels Assurance Scheme (RFAS), which verifies the chain of custody for renewable fuels and the downstream supply chain that is generating some very interesting information.

We've now calculated that there's probably about 10,000 trucks running on some kind of renewable fuel in the UK. But that's biomethane, predominantly renewable paraffinic diesel (HVO, hydrotreated vegetable oil), and about 2000 vehicles running on a high-blend biodiesel. In retail petrol and diesel, there's a percentage of biofuel, and over time, that will increase to other types of low carbon fuels. It's a very niche market at the moment. There's compatibility issues for biomethane for regional long haul duty cycles where trucks have got really high payloads. At the moment, the market for electric vehicles, whether that be battery electric, or hydrogen fuel cell, is in its infancy and companies now really need to focus on greenhouse gas emission reduction. These options are significantly cheaper at this moment in time. Obviously they have are cost implications, but it's much cheaper than, for example, buying a completely new battery electric truck for a long haul duty cycle.

We've now calculated that there's probably about 10,000 trucks running on some kind of renewable fuel in the UK

Intertraffic: In terms of common barriers to electric car purchases, it's always either the cost of the vehicle or the lack of available charging points. Is that also the case with the haulage and logistics industry?

GE: At the moment we're seeing electric trucks go into urban areas for last mile delivery. The capital cost will be much higher than the incumbent diesel truck, but on a whole life cost basis because of lower fuel costs, electricity is cheaper than fuel, that over probably over their lifetime, they're going to be a viable opportunity. The challenge comes with the long haul sector because there isn't yet product [electric trucks] on the market.

For fleet operators having that capital cost of putting down that investment is going to prove difficult

The infrastructure for long haul and for cities isn't there in terms of fast and rapid charging, so cost will be an issue. For fleet operators having that capital cost of putting down that investment, even though over their lifetime the vehicle might be cheaper to run, is going to prove difficult, and probably getting that financing and leasing, you're still going to have to put down a certain amount of money. So yes, cost is one thing.

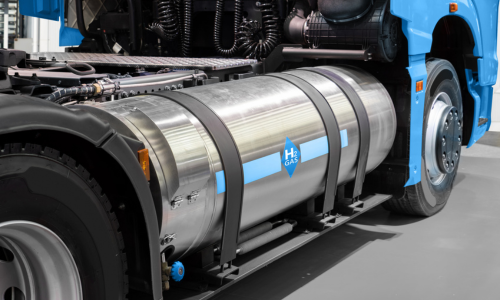

There are government incentives for alternative fuel trucks at the moment, but they only contribute £20,000 (€23,000) of the purchase cost. If you're looking at buying a hydrogen fuel cell truck today, you're looking at something in the region of £450,000 (€520,000), around three times more than the diesel equivalent.

Intertraffic: What are the main issues with the infrastructure?

GE: Infrastructure is going to be a big issue for battery electric, and plug-in charging, as you're going to need public charging and that is still in its infancy. It’s the same with hydrogen that has got its own challenges with regards to how you store it and the volume that you can you can store – there’s various health and safety requirements at play there. So yes, it's infrastructure, it’s cost and its product on the market. So at the moment, when it comes to long haul, for the OEMs there is no clear path as to whether it's going to be battery electric and hydrogen fuel cell or hydrogen ICE (internal combustion engine). They're all taking different kinds of approaches to that zero tailpipe technology.

If you're looking at buying a hydrogen fuel cell truck today, you're looking at something in the region of £450,000 (€520,000), around three times more than the diesel equivalent

Intertraffic: We recently ran an article on the Swedish electric autonomous vehicle pioneers Einride. How much of a great leap forward is the combination of “zero tailpipe” and driverless technology?

GE: I think with electric trucks, you've got a lot of interest in what's known as catenary [similar to overhead cables that power electric trains, providing current that is picked up by pantographs mounted on top of specially-equipped trucks]. For example, Scania has been working on a project with Siemens in Germany, so yes there's interest in that as well. But it's very much a case of the truck being completely aligned technologically with the infrastructure and how many manufacturers are going to be offering that solution?

Who is going to pay for that infrastructure on a national basis across the whole country?

Logistics companies operate with very small margins - they have to develop ways to deliver very quick timelines, so how is that going to work if you're going to have to spend three quarters of an hour charging your vehicle? Those are those are some of the practical and economical issues. Also, one thing you've got to understand about hydrogen is that although it has an improved energy density than diesel, it suffers volumetrically. So when it comes to a hydrogen refuelling station, there are going to be certain health and safety requirements that are going to come into place that are going to limit the storage requirements. All of these things need to be considered from both practical and financial standpoints.

Intertraffic: We’ve focused our discussion on the UK, but what about Europe?

GE: We also need to think about what's happening in Europe because these trucks’ duty cycles will mean that they'll be operating there as well. You need to have alignment in the infrastructure on both sides of the water, essentially so that there is interoperability. This is why in the interim period low carbon fuels have an intrinsic role in decarbonisation because they act as a bridge. In some cases, if you've got haulage companies that are transporting heavy aggregates, for example, or very heavy payloads in general, that's going to be challenging with an electric vehicle, potentially with hydrogen, whereas a low carbon fuel will have a very good opportunity, because it's got an equivalent energy density to diesel. So there's some of the things we need to consider.

When it comes to a hydrogen refuelling station, there are going to be certain health and safety requirements that are going to come into place that are going to limit the storage requirements

Intertraffic: One of the many interesting points in your report was the focus on renewable diesel. In terms of everything we're talking about, how feasible and viable is renewable diesel? What are we looking at in timelines in terms of a potential practical timeline?

GE: You are only going to be able to replace a certain proportion of fossil diesel with renewable over time, but that is going to be very much predicated on the direction of travel of government regulation, and demand. Now, at the moment, Hydrotreated Vegetable Oil (HVO) is more expensive than conventional diesel, for example, renewable diesel. Fleet operators do need an incentive, hut once that demand comes, supply will come as well. But there are challenges. We have to think about the availability of biomass feedstocks, and where there will be other demands over the next 10 years. And some of those feedstocks are also for sustainable aviation fuels as well.

We've got new capacity coming in from the US and from Asia as well. Some of the very big HVO suppliers, such as Neste, have expanded their plants both in Europe and in Asia, which is really encouraging, but we've got to appreciate the type of feedstocks and their availability.

This has been the subject of a lof of work by Imperial College in London and they have indicated that there shouldn't be an issue with available feedstocks going forward and there will be enough to go around. The processing of feedstocks is going to improve, allowing a wider pool to produce these fuels.

Some of the very big HVO suppliers, such as Neste, have expanded their plants both in Europe and in Asia but we've got to appreciate the type of feedstocks and their availability

Intertraffic: What are the latest developments with biomethane?

GE: Biomethane has been doing very well and is a very good opportunity for decarbonisation in articulated truck fleets. The 44 tonne trucks have been very attractive for logistic fleet operators, now that biomethane has a lower fuel duty than diesel.

The vehicles themselves are more expensive, but that pay back can happen over two or three years if they're using large volumes of biomethane because it's cheaper. We’re seeing an increase in the number of fuelling sites, and I think in the next five years, we should be up to around 60 refuelling sites, both CNG (compressed natural gas) and LNG (liquefied natural gas) across the country. What are we seeing here is the private sector really making a big move in terms of installing those sites.

Intertraffic: As for incentivisation, as you alluded to earlier, how do you incentivise a large logistics/haulage company to make that significant change to a truck fleet powered by renewable fuels?

GE: Fleet operators will need some sort of incentive and fuel duty could be the easiest way of doing it. About 15 years ago, there was a fuel duty discount for biodiesel, about 10 pence (€0.12) per litre. So something along those lines might be appropriate, although it probably needs to be higher, but it could be proportional to the content of bio-renewable fuel. Say, for example, if you had a blend of 20% or 100% bio-renewable fuel, the discount could be proportional to the bio-content of that fuel.

The biggest cost for a fleet operator will be their fuel, so one way of incentivising that and to bring some sort of cost parity would be to lower the cost of fuel duty, linked to the bio-content of the fuel

There's no incentive, for example, for gas trucks. The government's not providing any sort of grant for gas trucks and there is no incentive and no fiscal incentives for infrastructure. The focus is all on zero tailpipe emissions. The biggest cost for a fleet operator will be on their fuel, so one way of incentivising that and to bring some sort of cost parity would be to lower the cost of fuel duty and as I said earlier, that could be linked to the bio-content of the fuel. For example, for diesel or for paraffinic fuels, if there was a blend of renewable content, the duty could be discounted relative to that, that proportion of renewable fuel. We've submitted the report to the Treasury and the government is producing a low carbon fuel strategy. The small fleet operators that represent the majority of the UK’s truck fleet really need some help. They've only got a few trucks and they don't have the capital in order to make that transition.