INTERTRAFFIC: In 2014 Chris Urmson, who was then heading up Google’s self-driving car project, said that balance of human-driven vehicles would drop below autonomous vehicles around the time his then-12 year old son was old enough to drive. Was that an overly ambitious statement or was it realistic and in which case did something unforeseen occur that hampered technological development? Whatever it was, that obstacle has been well and truly surmounted or circumvented.

RB: "There was that kind of talk back then… and through 2015 to 2018. Every decade is like a marking point - everybody was saying 2020, 2030 but I heard that his introduction dates for Google were 2018 for their first robotaxis. We’re kind of there for Waymo, which is what spun out of Google, they have launched fully driverless services to the public. The difference here is that the people who follow automotive journalism were used to how OEMs talked about things. When an OEM introduced a product that had radar-based ADAS, it could be used everywhere. By contrast, automated driving fleet operations are very specific geographically, and very limited in function, but it's still got a useful function and a useful use case. I've been asked the question of ‘when’ over and over and over again. The actual question should be ‘when and how much?’ as that's when it starts to matter. We've got the first driverless robotaxis now. They will scale modestly over this coming decade. But on the truck side, where I'm very active, the business case is so strong there. We’re looking at 30-40% reduction in cost to move freight! That could scale a lot quicker. They don't have the first driverless vehicles out there at this time, but they're pretty close within a couple of years."

INTERTRAFFIC: Long-distance trucking always seemed like the most viable route to mass market acceptance for autonomous vehicles, especially looking at let's say, Australia, where truckers have to transport goods from Perth to Sydney on one road that stretches for several thousand miles across the country. You are hugely involved in the trucking side of things, so was that a bit of serendipity that you got so entrenched into that or was that a deliberate move on your part?

RB: "Oh no, it was serendipity, just by me circulating amongst all that was going on. I was actually supporting Auburn University in Alabama and their research efforts and I still am. And the professor there, Dr. Bevly, knew the CEO of Peloton Technology because they'd gone to Stanford together. We started working together, and it just grew from there. In terms of the investor community, it's funny, because the original buzz was about passenger car activities rather than trucks, but it seems like in the last three years or so, the investors kind of woke up and thought ‘Wait a minute – trucks! Wow, that's where the return on investment looks a lot better!’ And you're not trying to create a new business called robotaxis, this is an existing business where you're replacing driver with automation. Now, in the COVID era, trucking looks a lot stronger to the investors than the other use cases."

INTERTRAFFIC: So what would it need for that to become a reality in the next five to 10 years? Will it need a global haulage firm, a FedEx for example, to plunge headfirst into automation? Is the freight sector waiting for a company of that size to put its hand up and be the first or is this a technology that maybe isn’t entirely ready yet?

RB: "That is one pathway forward and I would say it's the most likely. There are also trucking companies like Kodiak that just develop the technology then create a fleet of autonomous vehicles and start moving freight around. So it's possible for this to start on its own, independent of an existing fleet, but UPS has been visibly active in this space, FedEx a little bit, and a few others. You know, they're watching very closely but I think you’re right, it will be triggered in a large way by those guys."

Image: Plus > Sensor rack on a Level 4 driverless test truck for Plus

INTERTRAFFIC: Where do the major truck OEMs fit into the scenario, though? We’re talking about startups and innovators here, but what about the likes of traditional truck manufacturers such as Mack or MAN?

RB: "A really important turning point with the truck OEMs was in the last year or so. The startups could buy a truck and they hack into them and apply their software to figure out how to do this robustly. And that's fine to get started. But the time came when they had to get more and more integrated with the truck, the innards of the truck, the electric power system and the brakes and engine, so what's happening now is a much deeper integration between the startups and the old guard coming together. They know they need each other to make this happen. And we've seen some things in the news with TuSimple working with Navistar and others, Waymo has placed an order with Daimler Trucks to deliver OEM factory-built trucks. And the key part of this is there's an infrastructure inside those trucks that is needed for level four autonomy, which is redundancy in the braking and steering plus cooling systems for the electronics and redundancy in electric power, all of that. The startups can't do that by themselves - it needs to come from the factory, so we may see some retrofitted driverless trucks in the next year or so. Small numbers, but the general consensus is 2024 is when the factory-built systems will be coming off the production line. And then that'll be another turning point."

INTERTRAFFIC: So with regard to the next five years, as 2024 is only three years away, in terms of passenger vehicle automation, where do you see that going? You're in the best place of anyone on the planet to answer this question, so where are we going to be? Are we now, in late 2020, where you thought we’d be in 2015 in automation implementation, or has the sort of the landscape changed?

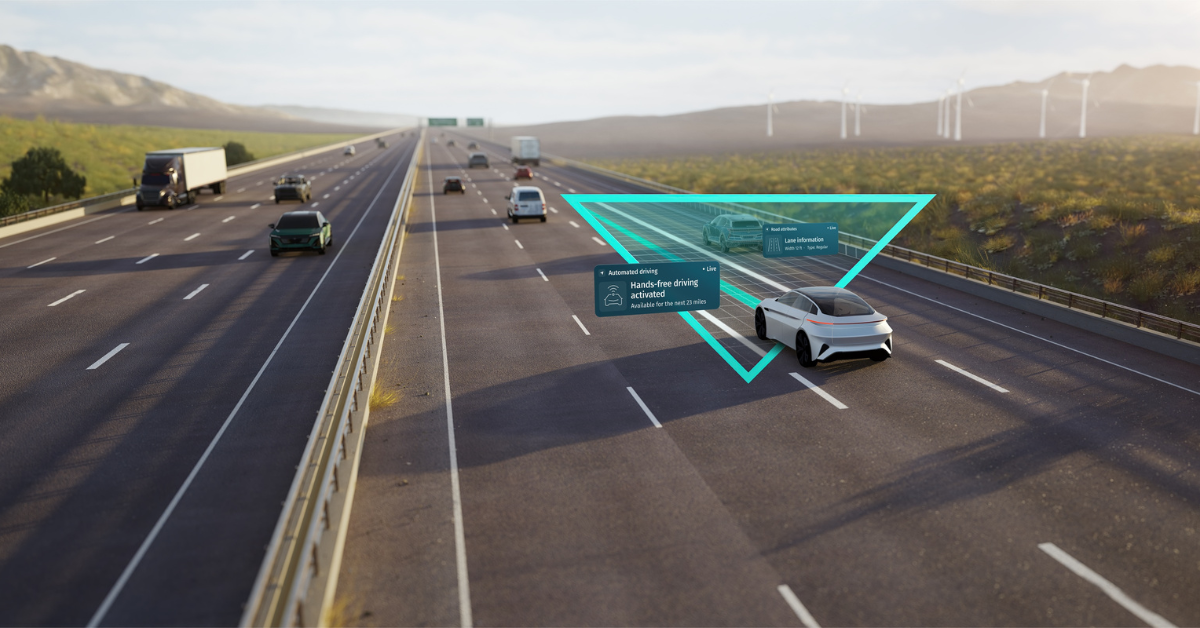

RB: "We have two important threads here. One is the personally owned vehicle that you buy from an automotive OEM and the other is the fleet and robotaxi guys. So in the personally owned vehicles space we know from lots of car manufacturers that you can buy an advanced level two system that does the lane keeping and longitudinal control and high convenience factor there. Tesla does more than that but they don't do full self-driving, even though that's their words, but they are pushing the rest of the industry. They're the most aggressive in terms of function, and the customers absolutely love it. So what we're seeing is an incremental approach from the car manufacturers. Level three, the idea that the driver can be hands off, feet off and eyes off while the system takes care of driving, even though you have to leave your brain on to take over upon request. That's been delayed. That was the kind of thing that was promised originally around 2020 but didn't happen because of regulatory issues. BMW and Mercedes both indicated that level three autonomy will come at the end of 2021 and we'll see others doing that. Level four is some time off, though, and I think the OEMs are not in a huge hurry. They were at one point, there was a lot of excitement for a while, but now the attitude is that they'll get there when they get there."

"The general attitude on level four automated driving is that they'll get there when they get there."

"On the robotaxi side it will scale at its own pace. I don't know how fast it'll go, honestly. But we’ll see Cruise Automation, which has been active in the city of San Francisco, very soon going to actual driverless. So we're now at the point where we’re moving from safety driver in the automated car to a completely driverless car. So you know, the joke has been how can you tell if a car is driverless? Well, it's got two engineers in the front seat."

INTERTRAFFIC: What do you think is the next big kind of eureka moment for the autonomous vehicle sector?

RB: "That's a good question. There’s a couple of things, I'll do some random access here. You know, right now, the robotaxis are running on fairly benign streets, so they can only operate in limited geographic areas, so they can only serve a certain number of trips. To use Silicon Valley as an example, that's a place where to even take a two mile trip in an Uber, you're probably going to go on a street for half a mile, and you're going to zip up a little freeway ramp, and then you’ve got to get off at the next exit, then you go to your destination. So this transition of robotaxi capability to both highway and street is going to be really important. They've got to do that. That's part of scaling up. San Francisco is a jurisdiction that talks about the need to apply some kind of a tax or fee on ride-hailing, in general, but even on robotaxis so that fee would go up or down based on the number of passengers you had in the vehicle to try to encourage more ride-sharing of a ride, even though COVID has pushed back against that. And so that regulatory side is going to be really important. There's going to be some pioneer jurisdictions that look to implement that in Europe, probably Australia and the US."

"When you can move a load cross country automated in two days, instead of six days, it affects some freight that moves by air, which also has an environmental benefit."

“On the truck side I think it's the mundane things of how do you really integrate these trucks with automated capability into an overall freight situation, the broader logistics, and then in even a much broader sense the supply chain. Supply chain folks don't think about trucks, they think about goods, and how to get these goods to move back and forth. My favorite example is if you've got a truck that needs to go from California to Pennsylvania, that's probably a six or seven day trip, because of the required driver rest times. The company I'm working with, Plus, are developing automated trucks that did what I call the ‘butter run’ from Pennsylvania to California. A truck loaded with a shipment of butter made the trip in two days because the truck didn't have to stop – there were no driver rest times involved. When you can move a load cross country in two days, instead of six days, it affects some freight that now moves by air, for instance, because of the delays of trucking. For refrigerated loads, you've got a refrigeration unit, keeping all that butter cold for six days, but now for two days with an automated truck. So, you've got an environmental benefit there. I think that's just the tip of the iceberg. Automation driving is going to ripple through the supply chain in myriad ways. I'm really looking forward to see how that plays out.”